Nice infographic from ONLINECOLLEGES.COM

It's a bit US-centric, but then so is the whole chord-cutting debate. Good food for thought in any case.

2020 lookout for value added services

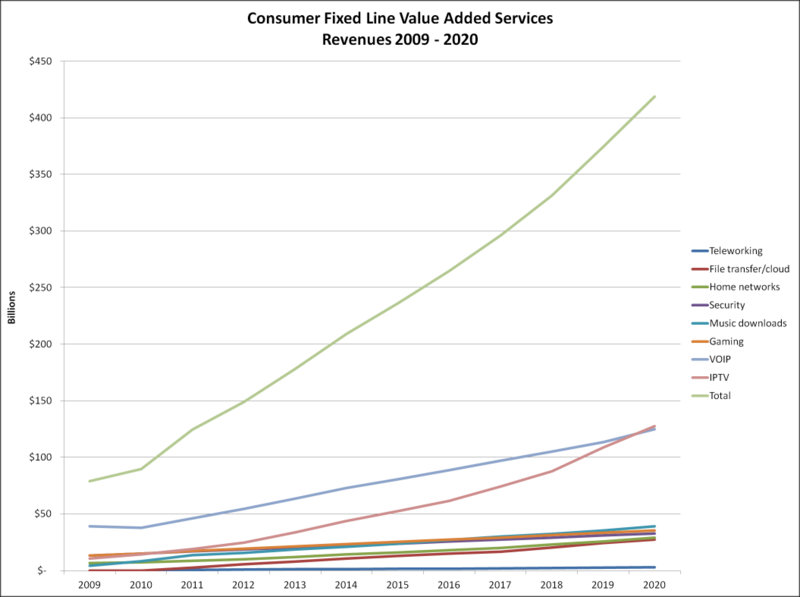

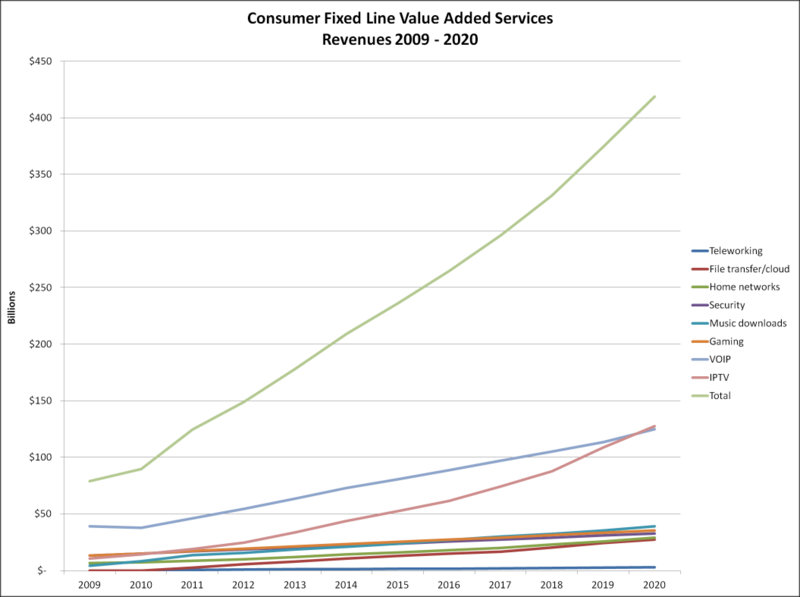

According to Oliver Johnson, CEO of Point Topic, Consumer Value Added Services (VAS) Revenues are to Triple to $420 Billion in 2020. Wow! Tripling in 10 years is a compound annual growth rate of about 14%.

Johnson used the following graphic during a presentation at CommunicAsia 2012 earlier this week:

Source Point Topic (CommunicAsia 2012)

Who wouldn’t want to operate within such an industry?

That got me thinking, who indeed?

Much of what makes up these VAS aren’t yet in the scope of global juggernauts Apple & Google. On the contrary, all seem to be very Network operator centric.

So why then are my friends at major European Telcos so gloomy?

Point Topic have looked at current VAS and projected them to 2020. That’s a good approach to get an idea of market size, but doesn’t show who’ll be selling the services by 2020 i.e. in an IP lifetime.

Let’s run through Point Topic’s 8 VAS:

1. IPTV – this may still be Telco’s exclusive hunting ground but as I just wrote in a white paper, IPTV is being complemented with OTT. By 2020 there will be no distinction between IPT & OTT. If Google and Apple take too long to get their TV acts together the Netflix’ of the world will have carved out a big piece of this pie for themselves. Otherwise for Telcos to stand a chance of staying on top of this market, they’ll need the support of regulators and crazy laws like ACTA to exterminate what’s left of Net Neutrality.

2. VoIP – again what could be construed as Telco hunting ground, is already dominated globally by the likes of Skype so isn’t voice is destined to become free? I asked Point Topic to explain why they see so much VoIP revenue in 2020. Oliver told me “VoIP currently has the largest share of fixed line consumer VAS & will still grow slowly (see chart).” So what about free VoIP? “While operators are offering free VoIP, it’s often only free to other VoIP connections and sometimes only to users on the same ISP. There are still going to be plenty of calls to mobile and standard fixed phones and along with those ISPs that do charge for VoIP as part of a bundle this still adds up to a pretty good revenue stream”.

3. Gaming – Gaming is classified as just another VAS, but this industry obeys its own complex rules. Most gaming industry pundits believe that the big editors like EA or Valve will lose out to more innovative smaller outfits. Operators have been trying to capture some of the value here for over a decade. I don’t see why they should be any more successful in the future than in the past.

4. Music downloads – I’m surprised that this market is still seen as existing by Point Topic. At the last party with dancing, that I went to, people asked for a Deezer connection to play their songs, rather than hooking up their iPhone. To justify downloading, the size of files must be large relative to available bandwidth. If there are say, stereoscopic 4k videos in 2020, then maybe video downloading will still exist, but I don’t see how downloading will remain relevant for sound files in 2020. So if this revenue is generated from streaming, then network operators might just scrounge the scraps, with the lion’s share of this market remaining with service providers like iTunes or Spotify.

So I asked Point Topic why they kept this segment until 2020. Oliver answered: “streaming will become more popular, but it can still be patchy. Unless you want to use your mobile bandwidth while out of reach of free WI-FI, or eat your much larger fixed allowance then just for efficiency’s sake, users will want to download once and share that file amongst their devices. Memory/disk space if just cheaper and more reliable than having to be in the cloud the whole time. In addition we still retain the desire to 'own' something, even if it's bits on your disk drive, having something to hand is more convenient and more desirable. Just look at the Megaupload case to see what can happen to your data if you trust it to someone else.”

That’s where I beg to differ, because I think connectivity will be so much better and even more ubiquitous in 2020.

5. Security – I have no doubt that there will be a gold rush on this market. Of course anyone selling spades will make a fortune, but beyond the obvious B2B market, the jury is still out as to whether the public at large will spend significant budget on remote sensors, cameras, and the like. If the segment were to include home automation, it might stand a better chance. But it’s still a level playing field so anyone could come out on top.

6. Home networks – this is a new frontier, which I’m excited about. People are in pain and we don’t even know how to start fixing their problems. Part of the solution will include more robust and simple networking technologies, some monitoring and helpdesk services, content discovery and DLNA approaches to in-house content sharing. But if home networking can’t be made easy very soon, it may never make it as a mass market, because the Cloud is already here...

7. File transfer / cloud – I would have guessed this would be the big one in a 2020 market. Watching Dropbox make an impact in both business and consumer segments in parallel shows that there is a clear demand here. In an 8-year window I could easily imagine the descendants of Dropbox taking a slice out of whatever I’m willing to pay for access to content. Amazon seams to believe in the link between hosting services and the content therein. The experts at Point Topic have plotted a line based on today’s typical file transfer service. Again I have no issue with the method to get to a market size, but this is an area where services in 8 years will be so very different, that it probably doesn’t mean much anymore.

8. Teleworking – Teleworking was always going to be so very important so very soon. The technology has actually been available for many years. The success or otherwise of teleworking will now be driven by what is socially and / or professionally acceptable in terms of behaviour and work ethics more than by any new service or technology. So I see no reason for the tiny size or the stakeholders of the Teleworking market to change over what is - for social change - a short period of time.

You can see Point Topic’s press release here.

Why CAT-iq matters

It is a fair bet that not many people even in the broadband and broadcast community have yet heard of CAT-iq, while at the same time they may have forgotten about its predecessor DECT, the digital cordless telephony standard. Yet DECT is still very much alive and well, while CAT-iq (Cordless Advanced Telephony – Internet and Quality), has emerged as a very important wireless standard for the home network that will run alongside WiFi. It can be regarded as the next generation of DECT, but is more than that, since it goes beyond voice to place a stake in the emerging world of converged home networks that will bring together all the digital media and communications needs of the home within a single infrastructure. CAT-iq does not do the whole job, because it is a low bandwidth standard for voice, data and home automation, leaving Wi-Fi to distribute broadband services and HD video. But as the name suggests, CAT-iq brings convergence with the Internet, while adding support for high quality of service focusing primarily on high definition voice, specifying mandatory levels for various quality parameters. For these reasons it is of great interest to vendors of home operating platforms such as SoftAtHome, which has become the first software provider to gain certification on an Home Gateway for CAT-iq 2.0 from the CETECOM laboratory, one of the official qualification laboratories of the DECT Forum.

CAT-iq represents a new level of ambition for DECT, since it breaks away from the purely voice focus to take on other, so far better known, RF (Radio Frequency) technologies for low power audio, signaling and automation communications within the home, notably Zigbee and Bluetooth. The reason for CAT-iq’s ability to take these on lies in DECT’s pedigree as a long proven technology for distributing voice and data within the home with very low electromagnetic emission and power consumption, which have become more important with the growing focus on energy use and green issues. It also avoids royalty payments, and is low cost because of the economy of scale already achieved through a large community of DECT system manufacturers, while unlike the other RF technologies including ZigBee and Bluetooth it is immune from interference from Wi-Fi interference in the 2.4GHz band. The latter is very important, because WiFi is the only game in town for short range wireless HD video delivery, and so whatever low power technology is used for home automation will have to coexist with it. For these reasons we will be hearing a lot more about CAT-iq, even if it does not quite become a household acronym.

[blog written by Philip Hunter for Videonet]

OTT White paper (short version)

Short version of the June 2012 Viaccess-Orca (now VO), Harmonic and Broadpeak White Paper on the technical challenges and business imperatives of OTT.

OTT White paper

Long version of the June 2012 Viaccess-Orca (now VO), Harmonic and Broadpeak White Paper on the technical challenges and business imperatives of OTT.

IPTV is dead long live OTTIPTV

I’m almost three weeks late for my write-up of this year’s IP&TV world Forum, so I started this piece for my blog in a rush with a big sense of guilt. It turns out that my intro on the IPTV Vs. OTT debate has taken turned in to an opinion piece on it’s own (follow-on report on IP&TV World Forum 2012 coming soon with interviews from Envivio, Verimatrix and Media Melon CEO’s as well as news and demos from Ineoquest, Siemens, Harmonic, Orca and some others).

For the sake of clarity, in this piece, I’ll use the term IPTV to describe TV delivered over managed networks with guaranteed quality of service as opposed to OTT delivery that has to go over networks not managed by the service provider. IPTV services are generally those delivered by Telco’s (e.g. Orange TV, ATT Uverse), whereas OTT services are usually offered by content owners (BBC, Hulu) or dedicated start-ups (Netflix, Roku).

I gave my first IPTV presentation in 2004. Some visionaries were already talking about OTT. But that’s another story. The first thing I did then was to define the term IPTV because no one agreed on what it actually meant. As far as buzzwords go, IPTV had a pretty good run for its money, staying trendy for almost a decade.

Prior to this year’s IPTV show, I predicted on my blog that OTT would be the only common theme for the second year running.

This year’s IPTV world forum was the biggest yet, yet it was the last. Next year the show is being rebranded. (Incidentally as the IP&TV rebranding never took, I wonder if the new TV Connect rebranding will fare any better; IPTV is a strong brand name). That must be saying something. Has the great IPTV ship sunk under her own weight?

Is IPTV really gone for good, or has it just gone out of fashion? I remember wearing a scarf of my grandfather’s a few years after he died. He’d had it for decades. Yet when I wore it on one evening, I was amazed to receive compliments on being so trendy (I actually have no dress sense when it comes to fashion as you may have noticed). As it happens the design was just making a comeback.

Likewise, might the IPTV World Forum comeback in 20 or 30 years? You’re probably laughing at such a stupid question: technology isn’t like clothing. Well maybe so, but people respond to fashion in the same way whatever the subject.

Some say IPTV has failed because big Telcos that ploughed hundreds of millions of Euros into the technology have not recouped their investment. We’ve tried for years to convince ourselves (and investors) that IPTV was a sound defensive strategy. All the clever multi-play bundling was keeping customers from churning. Actually it was, it’s just that it only put a plaster on the wound without healing it first. IPTV is just a tool and teaching someone how to use a tool from another trade, doesn’t teach her how to actually make a living out of that trade. Belgacom is a very rare counter-example amongst Telcos - having put a real TV exec at the steering wheel; they are now the only ones who can actually claim genuine IPTV success. Ironically much of their technology has recently gone obsolete as NSN their main provider has decided to drop IPTV products.

It’s probably significant that at the same time Siemens (not Nokia Siemens Networks, i.e. NSN) is making a big push back into the TV space, but with an exclusively OTT model.

So what has actually failed with IPTV is the Telco’s attempt to use TV to climb up the value chain. The technology itself needed a few years to have the wrinkles ironed out, but works very well now.

The market cap of any major Telco with a big IPTV offering, when compared with that of Apple or even Google, tells the same story.

Last year I wrote a successful blog entry on why France, having been the birthplace of IPTV, would probably also be its first grave. The article generated a thread of over a 100 comments on LinkedIn and I was quite chuffed when Gavin Whitechurch the head of IPTV World Forum series gave me an analyst spot at last year’s London forum.

My “the death of TV” analyst briefing was a learning experience. There were five other analyst tables and as doors opened, delegates came in and chose their table. The other tables were about fine things in the future (namely OTT) and most had about six people - one even had a dozen. Mine had none! So I’ve learnt from that marketing mistake: this article isn’t about IPTV’s woes but about OTTTV’s great potential.

Back to the real reason I believe it is simply a question of fashion. The current fuss over OTT is still about delivering TV through the Internet Protocol. If we didn’t suffer from a need for novelty all the time we’d be calling it IPTV because it still is.

Delivering video service OTT won’t kill IPTV. On the contrary it’s going to complement IPTV delivery and even help it by extending its reach. It’s an ideal technology for IPTV operators to delivery multiscreen or TV-anywhere experiences.

We’re just finishing a White Paper with Harmonic, Orca, Broadpeak and Viaccess on this very topic. Before OTT can make managed IPTV delivery obsolete, we’ll need a very different Internet from the one we have today. There will be a market for delivering TV over managed networks as far as technology roadmaps can go.