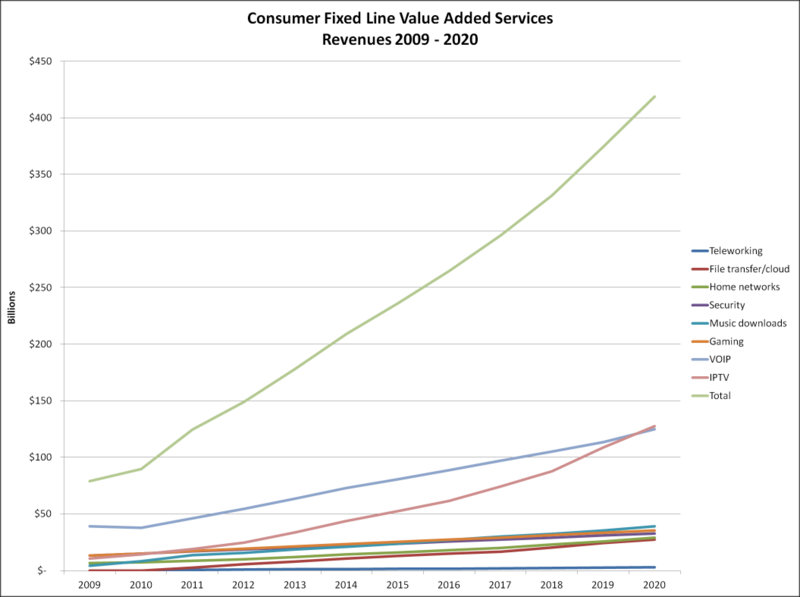

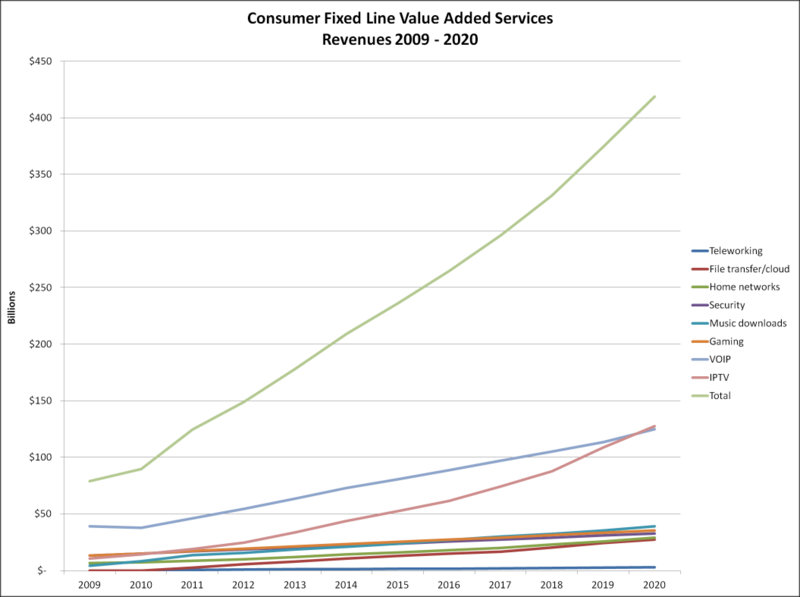

According to Oliver Johnson, CEO of Point Topic, Consumer Value Added Services (VAS) Revenues are to Triple to $420 Billion in 2020. Wow! Tripling in 10 years is a compound annual growth rate of about 14%.

Johnson used the following graphic during a presentation at CommunicAsia 2012 earlier this week:

Source Point Topic (CommunicAsia 2012)

Who wouldn’t want to operate within such an industry?

That got me thinking, who indeed?

Much of what makes up these VAS aren’t yet in the scope of global juggernauts Apple & Google. On the contrary, all seem to be very Network operator centric.

So why then are my friends at major European Telcos so gloomy?

Point Topic have looked at current VAS and projected them to 2020. That’s a good approach to get an idea of market size, but doesn’t show who’ll be selling the services by 2020 i.e. in an IP lifetime.

Let’s run through Point Topic’s 8 VAS:

1. IPTV – this may still be Telco’s exclusive hunting ground but as I just wrote in a white paper, IPTV is being complemented with OTT. By 2020 there will be no distinction between IPT & OTT. If Google and Apple take too long to get their TV acts together the Netflix’ of the world will have carved out a big piece of this pie for themselves. Otherwise for Telcos to stand a chance of staying on top of this market, they’ll need the support of regulators and crazy laws like ACTA to exterminate what’s left of Net Neutrality.

2. VoIP – again what could be construed as Telco hunting ground, is already dominated globally by the likes of Skype so isn’t voice is destined to become free? I asked Point Topic to explain why they see so much VoIP revenue in 2020. Oliver told me “VoIP currently has the largest share of fixed line consumer VAS & will still grow slowly (see chart).” So what about free VoIP? “While operators are offering free VoIP, it’s often only free to other VoIP connections and sometimes only to users on the same ISP. There are still going to be plenty of calls to mobile and standard fixed phones and along with those ISPs that do charge for VoIP as part of a bundle this still adds up to a pretty good revenue stream”.

3. Gaming – Gaming is classified as just another VAS, but this industry obeys its own complex rules. Most gaming industry pundits believe that the big editors like EA or Valve will lose out to more innovative smaller outfits. Operators have been trying to capture some of the value here for over a decade. I don’t see why they should be any more successful in the future than in the past.

4. Music downloads – I’m surprised that this market is still seen as existing by Point Topic. At the last party with dancing, that I went to, people asked for a Deezer connection to play their songs, rather than hooking up their iPhone. To justify downloading, the size of files must be large relative to available bandwidth. If there are say, stereoscopic 4k videos in 2020, then maybe video downloading will still exist, but I don’t see how downloading will remain relevant for sound files in 2020. So if this revenue is generated from streaming, then network operators might just scrounge the scraps, with the lion’s share of this market remaining with service providers like iTunes or Spotify.

So I asked Point Topic why they kept this segment until 2020. Oliver answered: “streaming will become more popular, but it can still be patchy. Unless you want to use your mobile bandwidth while out of reach of free WI-FI, or eat your much larger fixed allowance then just for efficiency’s sake, users will want to download once and share that file amongst their devices. Memory/disk space if just cheaper and more reliable than having to be in the cloud the whole time. In addition we still retain the desire to 'own' something, even if it's bits on your disk drive, having something to hand is more convenient and more desirable. Just look at the Megaupload case to see what can happen to your data if you trust it to someone else.”

That’s where I beg to differ, because I think connectivity will be so much better and even more ubiquitous in 2020.

5. Security – I have no doubt that there will be a gold rush on this market. Of course anyone selling spades will make a fortune, but beyond the obvious B2B market, the jury is still out as to whether the public at large will spend significant budget on remote sensors, cameras, and the like. If the segment were to include home automation, it might stand a better chance. But it’s still a level playing field so anyone could come out on top.

6. Home networks – this is a new frontier, which I’m excited about. People are in pain and we don’t even know how to start fixing their problems. Part of the solution will include more robust and simple networking technologies, some monitoring and helpdesk services, content discovery and DLNA approaches to in-house content sharing. But if home networking can’t be made easy very soon, it may never make it as a mass market, because the Cloud is already here...

7. File transfer / cloud – I would have guessed this would be the big one in a 2020 market. Watching Dropbox make an impact in both business and consumer segments in parallel shows that there is a clear demand here. In an 8-year window I could easily imagine the descendants of Dropbox taking a slice out of whatever I’m willing to pay for access to content. Amazon seams to believe in the link between hosting services and the content therein. The experts at Point Topic have plotted a line based on today’s typical file transfer service. Again I have no issue with the method to get to a market size, but this is an area where services in 8 years will be so very different, that it probably doesn’t mean much anymore.

8. Teleworking – Teleworking was always going to be so very important so very soon. The technology has actually been available for many years. The success or otherwise of teleworking will now be driven by what is socially and / or professionally acceptable in terms of behaviour and work ethics more than by any new service or technology. So I see no reason for the tiny size or the stakeholders of the Teleworking market to change over what is - for social change - a short period of time.

You can see Point Topic’s press release here.