Let’s wind back the clock.

70’s – France’s young president elect Giscard d’Estaing comes to office and realizing that the French Telephone system is years behind those of other countries. Huge investment is ploughed into the state owned PTT. During the decade, France moved from an antiquated system to a state-of-the-art Signaling System 7 (SS7) Telephone network.

When I came to France as a boy in 1974 it took months for our family to get our first phone line installed – that was already a vast improvement over the previous decade’s standard 2-year waiting list. By our second move in 1977 it was just a few days, which seemed a bit like science fiction at the time and vastly impressed family and friends back home in the UK.

Before most people had heard of the Internet or IP, we were busy in France discovering online services with the Minitel system which saw it usage boom in the 80s and early 90s. The leading edge was taken off French Telecoms as there was then much hesitation of how to best react to the emerging Internet in the 90’s, embrace it or try to impose that national Mintel standard? By the time it became clear that the Web would replace the Minitel, other countries got to catch-up with the network savvy French and the European ISP business from the mid-90’s seemed relatively balanced although we were all trailing behind the US.

A combination of a sound regulatory approach and French business acumen the French Telco sector back on track in the second half of the 90’s.

Competition was introduced effectively without bringing the incumbent to its knees. Compared to the UK where BT was almost killed off by Thatcher or Germany where DT’s stranglehold on access networks is still to be fully broken, the French seemed to have got a pretty good balance.

So when Free, a new entrant in the ISP business built from a Mintel empire (ILIAD) aggressively launched their first triple-play offer in 2003, France Telecom was able to reciprocate and the other challengers like 9-Cegetel and Club Internet were also able to follow suite.

The French Telecoms subscribers saw the most incredible decade until about 2010 with always more services for a fixed price of about 30€. But Iliad/Free surreptitiously broke the 29,99€ rule it had forced on the industry, by removing a few standard features that became add-ons (like €1,99 for TV service). This improved ARPU and although detailed figures are hard to come by, it is no secret that ILIAD/Free make significant profit from their ADSL ISP-Business (a 40% margin is often cited).

This profit and a favourable regulatory approach (Free bought the 4th mobile 3G operator licence at a discount in 2009 paying just 240 M€ where the other 3 operators had paid 619M in 2000) meant that Free was able to launch a very aggressive mobile offering in January 2012. The success was immediate with about a million clients by the end of that month alone.

Despite being a free market economy, most French commentators agree that the 1000 layoffs competitor SFR announced in 2013 can be clearly attributed to Free’s price “dumping”. As an independent consultant based in Paris and focussed on new services, I’ve seen I’ve seen many operator projects canned this year due to innovation budgets being cut at Orange, Bouygues Telecom and SFR. French 4G is at least a 2-year behind what US operators have already deployed.

So what’s going wrong?

Too much of anything – even a good thing – can be bad. After proving that a balanced approach to (de)regulation really does work, France seems to have lost its unique touch.

The three incumbent Mobile operators were hoping that 4G would help fight off the low-cost battering from Free. But Free has entered the 4G market with a bang, announcing that 4G services would be provided at the same price as with 3G. All operators have had to follow suit ruining the basic tenet of Telco strategy, where superior services requiring significant Capex can bring in extra revenues. The only way forward seems to be lowering costs.

This situation of all-out war has led Bouygues Telecom to announce seriously low-cost ISP services to be detailed in January 2014, with as-much-as-you-can-eat triple-play offerings going for 15€ per month (compared to Free’s current 30-37€).

The price war has got out of hand to the extent that the French government has become involved in the industry-wide slanging match, although it’s not at all clear what it can actually do except maybe give the regulator some more power. If the situation keeps on escalating, subscriber glee will be short-lived in 2014 as one of the 4 operators is bound to go bust and maybe two other merge.

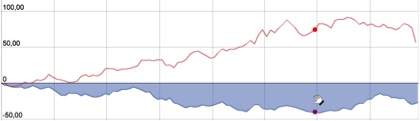

But if subscribers have so far only won out from this situation, shareholder prospects are less clear.

The situation is almost reversed if you look just at the last 6 months