Désolé, cet article est seulement disponible en Anglais Américain. Pour le confort de l’utilisateur, le contenu est affiché ci-dessous dans une autre langue. Vous pouvez cliquer le lien pour changer de langue active.

During a business lunch in 2002 I had my first real conversation with my boss’s boss’s boss in France Telecom. Joining the table late, I found the discussion already heated. Jean-Jacques Damlamian, the longest standing board member the company has ever had was then the acting CTO (I say acting because there was no such title, JJD as he was known internally is now retired). He was adamant: « We have just made the biggest mistake in the telecoms industry’s history, since Graham Bell. » France Telecom had launched its first commercial ADSL packages for private subscribers just a few years previously. Damlamian was referring to the fact that these packages were limited only in speed, and unlimited in volume of data. Already it was becoming clear some users’ requirements were thousands of times higher than the average user. France Telecom was budgeting millions of Capital expenditure for just a handful of subscribers.

Last week, David Amzallag, Amdocs’ new CTO explained to me how he believes his company’s vision might contribute to getting the industry out of the fatal trap it set for itself over a decade ago. I met him in the run up to the 2011 Broadband Forum in Paris.

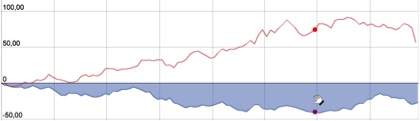

David just left from a 4-year stint as BT’s chief scientist. Those years spent on capacity planning, convinced him that even if networks get smarter and grow in capacity as fast as possible, current usage trends will outstrip our best efforts, leading to major bottlenecks and frustrated subscribers. David went as far as to say that T1s and T2 are in serious trouble as their bread and butter gets commoditized.

MPLS, one of those technologies supposed to make capacity management much more flexible, has delivered only part of the promises so far; capacity is running out anyway, however flexibly it’s managed. Amdocs see a metered future.

So based on the assumption that demand is going to exceed capacity, Amdocs commissioned a study on the future of data pricing from Heavy Reading. Amdocs’s core business is where Operations Support Systems (OSS) and Billing Systems (BSS) meet customer experience so they have a vested interest in the outcome. Reassuringly, the study concludes that operators believe users are willing to pay more for more and are willing to accept some kind of flexibility (Over 80% of interviewed operators said that their future plans include data plan shared between several devices e.g. tablet & smartphone. Also, over 65% said their future plans include data plans shared between several family members). Heavy Reading appropriately interviewed operators, because they are Amdocs’ customers. The research would carry more weight if it also included the opinions of real subscribers.

Amdocs don’t believe the problem will be solved with sponsored connectivity, where, for example, Facebook pay the ISP a few dollars to carry their traffic. David went on to say that the only way forward is for the network’s Operational Support Systems (OSS) to be better linked to the business issues.

He described several use cases with an overall data quota for the whole family across many devices. Parents might be prepared to pay a premium to be assured that during their single daily leisure hour, bandwidth was guaranteed. Children could swap their leftover bandwidth allowance amongst themselves. For the more tech savvy families, the hard-core gamer might even give up some bandwidth in exchange for better latency that the bandwidth hungry movie-buff sibling doesn’t need. Towards the end of the month, if the operator sends a warning message that data limits will be probably be exceeded, the family could decide either to extend existing plans for a premium or enforce lower usage until next month. Thus maybe watching a few older movies from the home NAS instead of streaming from the cloud.

For other customer segments like single adults, Amdocs sees people wanting to fulfil unique needs at specific times through different devices. Subscribers will be prepared to pay for this and data plans will need to be so flexible that David says the real name of the game will be personalization. He used the expression of “Quality of Service On Demand” and “dynamic customer profiling” to describe such cases.

These quota based premium packages could co-exist with unlimited ones, but Amzallag insists the latter would suffer much lower bandwidth. He said that net neutrality wouldn’t be completely gone as prioritization isn’t based on packet contents but on whether the customer is paying a premium or not. Of course the Net Neutrality activists would disagree saying that the corollary of prioritization is de-prioritization, which means blocking if congestion is too bad.

Other detractors can forcefully argue that there will be no turning back from “as much as I can eat” data plans. But the Amdocs vision addresses that pretty squarely saying unlimited data can co-exist with quota based plans. My remaining doubt is a central one. Do subscribers want this? The "Global Tribes" consumer research, conducted by Coleman Parkes, that Amdocs published earlier this year, addresses the question "are consumers prepared to pay more for more?" For most segments and markets it concludes reassuring that yes they are. However, having myself witnessed first hand how incredibly different markets around the world are; I avoid using patterns from one market to make deductions for another. UK and US customers are clearly being weaned away from unlimited plans. My gut feeling is that subscribers in the rest of Europe and places like Russia that benefit from fierce ISP competition might be harder to transition away from unlimited plans. Despite its recent problems, the Netflix model has proven it can fly; limited data packages could shoot the model straight out of the sky.

The context of the data plan debate will probably evolve rapidly as the boundary between the fixed-line and the mobile broadband markets gets fuzzier all the time. Quota based plans have been becoming the norm on mobile broadband. My daughter left home for a tiny 1-roomed flat in Paris last month and in looking for an ISP on a very tight budget, we concluded that using a mobile broadband subscription might be best – she only uses Facebook and email regularly and will keep away from streaming for now (which could incite illicit downloading when she’s back home, but that’s another story...) So I look forward to talking again with David maybe at next year’s Broadband World Forum, to see how things have panned out.

After writing this I found out on twitter that fierce competition on the iPhone 4S launch is pushing the big US operators back towards unlimited ... looks like the market may not be ready after all. Exciting yoyo times.